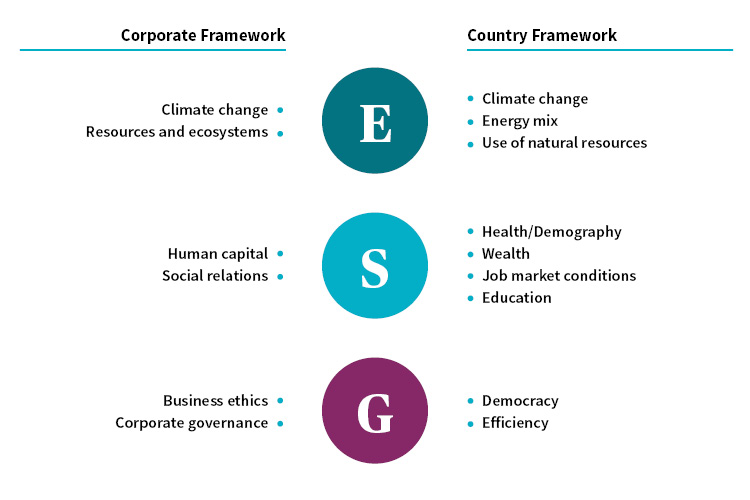

At Stocksgrin Invest, we define responsible investing (RI) as an investment process that incorporates environmental, social and governance (ESG) factors into its approach. RI enables clients to align their investments with global megatrends that are changing the investment landscape. Issues such as increasing regulation, the growing need for risk mitigation and a heightened social conscience can be more effectively addressed by integrating ESG factors into the investment process.

ESG can allow firms to foster a meaningful change in the global economy, and in the communities in which we live and work. We believe that ESG analysis leads to more effective investment solutions that address global challenges and create sustainable value for our clients.

The integration of ESG factors is used to enhance traditional financial analysis by identifying potential risks and opportunities beyond technical valuations, providing data on issues such as potential reputational risk or identifying firms which are adapting to meet new market challenges. It is important to note that the main objective of ESG integration remains financial performance.

We offer a bespoke, discretionary service to the majority of our clients through investment managers, financial planners, or a combination of the two. Therefore, our responsible investment approach will be tailored to the individual needs and objectives of the client.

We believe that high-quality companies which manage ESG risks and opportunities well will make attractive long-term investments. Our research team considers ESG factors when evaluating individual companies and when they assess fund managers. Through the use of Sustainalytics, a third-party provider of ESG data, material risks and opportunities are fed into traditional financial analysis and models for our ‘buy list' stocks.

Our research team address ESG issues in due diligence questionnaires for all funds considered for our buy list. The team also has a dedicated socially responsible investing (SRI) list for funds with a sustainability focus, and with restrictions on investment in harmful activities. The SRI list helps our investment managers select funds which aim to deliver attractive investment returns while contributing positively to global environmental and social challenges.

During suitability discussions with their investment manager, clients can choose to apply certain ethical screening criteria to their portfolio. Clients can select certain restrictions for direct holdings, and portfolios are then created and managed to reflect these restrictions.

Brewin Dolphin is committed to being a good steward of our clients' investments, to enhance and protect their long-term value. We are supporters of the UK Stewardship Code and have a tier one rating for our engagement work.

For each core holding, our research team will monitor and engage with company management on priority material issues that impact the value of our clients' assets, which include material ESG issues. This can be done directly or via collective engagement with other shareholders.

We report on all of our stewardship, engagement and responsible investment activities at least annually. Details of these reports will be available on our website.

Conflicts of interest may arise from our responsible investment activities. Any such conflicts will be recorded, considered, and dealt with in line with Stocksgrin Invest conflicts of interest policy. All colleagues are regularly trained to identify and address potential conflicts of interest.

This statement is intended to summarise Stocksgrin Invest approach to responsible investment. Overall responsibility for this approach is held by the Sustainability Committee, which reports to the Executive Committee. It was reviewed and approved by the Sustainability Committee in December 2020. Our responsible investment statement will be reviewed and updated at least annually

Our commitments include incorporating ESG factors into our investment decisions, starting with the due diligence of potential investments through to the exit process. We tailor ESG due diligence to each investment, and we create post-investment remediation plans for material ESG considerations. For all potential investments, we use internal experts and a variety of ESG frameworks to identify material ESG factors and utilize external consultants where appropriate. This analysis includes everything from ensuring environmental, legal and regulatory compliance to the identification of opportunities to add value or mitigate risk in our portfolio. Our investment teams use an ESG due diligence guideline to ensure consideration of material ESG risks and opportunities.

Upon company acquisition, we create a tailored integration plan to ensure that all material matters, including ESG risks and opportunities are prioritized. ESG risks and opportunities are actively managed by the portfolio companies with guidance from our in-house investment teams, primarily through representation on company boards and equivalent oversight bodies where all financial, operational, and strategic elements of the business are reported, considered, and where appropriate, approved.

This allows us to draw on local expertise, which provides valuable insight given the wide range of asset types and locations in which we invest. Certain key performance indicators, such as serious safety incidents, are reported regularly to the applicable board or other oversight body.

Responsible investment is no longer a niche pursuit, and in many ways is perfectly suited fro fixed income investment.

Stocksgrin Invest Prime rating aim to highlight ESG and climate risk to support better research and stewdardship, and to help build portfolios tailored to our client's interest.

In 2020, 90% of 1,210 engagements included ESG issues

Stocksgrin Invest added over 2bn of impact bonds to client accounts in 2020. 187 Client accounts at Stocksgrin Invest now have exposure to impact bonds.

Only 40% of the impact bonds we analyzed fully met our sustainability expectations in 2020

Stocksgrin Invest is offering greater transparency around our opeations, with new diversity target for our workforce.

We are always working to maintain sound governance practices to ensure ongoing investor confidence. This involves a continual review of how evolving legislation, guidelines and best practices should be reflected in our approach. For example, we have a zero-tolerance approach to bribery, including facilitation payments, and all Stocksgrin Invest employees are mandated to complete an in-depth anti-bribery and corruption (ABC) training seminar annually. Stocksgrin Invest maintains an ethics hotline to report suspected unethical, illegal or unsafe behavior. Our reporting hotline is managed by an independent third party and is available 24 hours a day, 7 days a week. We also require all portfolio companies in which we have a controlling interest to adopt an ABC policy that is equally stringent to Stocksgrin Invest's, which entails that portfolio companies install an ethics hotline within six months of acquisition.

Employee health and safety is a top priority at Stocksgrin Invest. We view health and safety as an integral part of the management of our business and therefore consider it a line responsibility best managed by portfolio companies. We have established a safety steering committee, which includes the CEOs and COOs of each business group, to promote common values and a strong health and safety culture, share best practices and monitor serious safety incidents. In the event that a serious incident does occur, Stocksgrin Invest conducts an in-depth investigation to determine root causes and formulate remediation actions.

Embedded in our culture is a commitment to advancing diversity and inclusion across our organization. This begins at recruitment, continues in leadership training programs and is woven into our policies and procedures. As a global firm, we know that the best ideas come from having people from different backgrounds, perspectives, experiences and skills across all businesses, levels of seniority and offices.

Training programs set clear expectations for our leaders in terms of their role in helping all team members achieve their potential. The training emphasizes building trust with their teams, becoming aware of unconscious biases and provides guidance on how to add rigor to decision-making especially in recruiting, performance feedback and promotion, with the goal of creating a more diverse and inclusive environment.

Our internal groups and networks, including a global Stocksgrin Invest Women's Advisory Committee and a Diversity Advisory Committee, actively advise management on how to make our Firm more welcoming to people from diverse backgrounds.

Stocksgrin Invest is committed to advancing economic and social mobility for our underserved communities by focusing on: